Life Insurance

I am a strong proponent of term life insurance.

In this post, I go against the common wisdom of 'getting your money back'1 and refute common arguments for whole life insurance. I propose, and defend, my recommendation to buy term life + critical illness coverage.

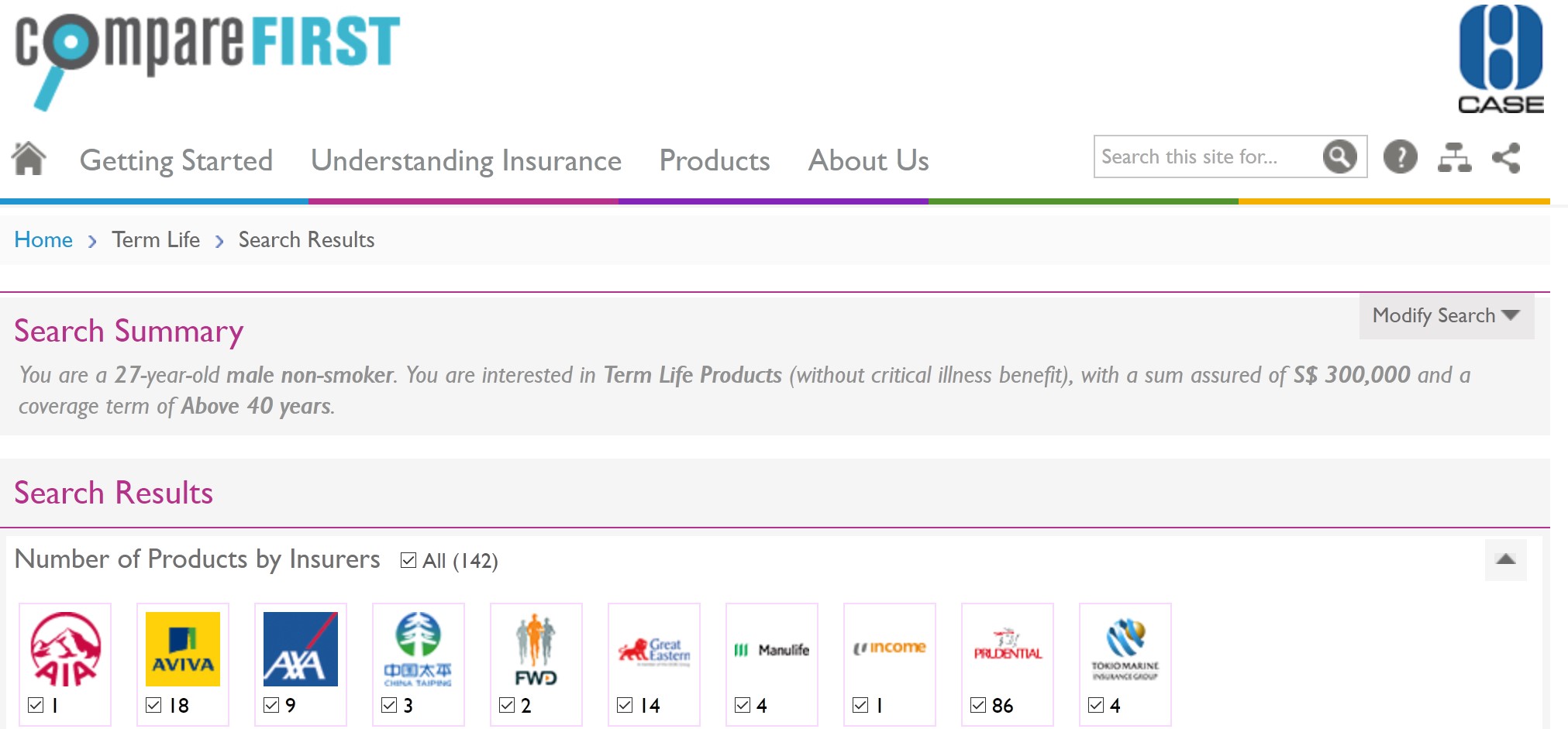

Of note, a good comparison of insurance policies can be found on comparefirst.sg.

Update (Jan 2024): MoneyOwl ~is~ was a service which independently assesses policies across insurance companies for you, and rebates you up to 50% of the commission they receive (of what your agent would normally get).

Term Life offers the same protection for a lower cost

This is the single most important reason.

Let's look at the premiums for a 27-year, male non-smoker, sum assured $300,0002.

For the sake of comparison:

- there is no 'multiplier' component on the whole life (note: a 'multiplier' is essentially term insurance3)

- the premium term for the whole life is until 80, for easier comparison with the term life

- I chose the lower-mid quotes for each on comparefirst.sg

| Type | Annual Premium | Premium Term | Total Premium |

|---|---|---|---|

| Term Life till 75 | $540 | 48 | $25,680 |

| Whole Life | $4,761 | 52 | $247,572 |

The term life is nearly 90% cheaper than the whole life, for the same coverage. You can invest the extra $221,892 yourself.

Another interesting effect: With inflation, the premiums you pay later on, actually become cheaper4. The rational individual should therefore prefer to pay over a longer period of time7.

Also, some term life policies are convertible, meaning you have the guaranteed option to switch to a whole life policy before a certain age (usually 65).

Common Arguments for Whole Life

Q: But I will definitely get my money back for the whole life plan!

A: Yes, but is it really worth paying 10 times more for that privilege? You could have invested in property, or paid for your children's education with the money you have saved. Don't forget - even if you get your money back, it's already worth less because of inflation4. $100 now is worth more than $100 in the future.

Q: How about the annual bonuses that the insurance company is offering? 3.75% is a lot!

A: Firstly, the bonuses are not guaranteed. Secondly, the bonus rates are significantly lower than what you can get from broad-based index investing - $100 compounded for 10 years at 3.75% is $144.59, while at 8% (US stock historical return) it is $215.89. You'd be better off buying a term life policy and investing the rest yourself.

If you don't think you can invest, put it all into CPF. The SA (Special Account) interest of 4%++pa/yr beats nearly all whole life plans in the market. In fact, just by having $130K in CPF by your early 30s, you could have $1,000,000 in CPF by 656.

Q: The coverage for term life ends at 75! What happens if I die after that? I get nothing!

A: This is one of the biggest misconceptions with insurance. Insurance isn't an investment. It's meant to cover you in the unlikely event a major catastrophe befalls you when you're still building up your nest egg, or when you have dependents. Think about it - if insurance were a surefire way to earn money, how would the insurance companies profit? They're not running a charity.

I chose 75 to be the cover end date for the term policy, as that is when you should be financially independent, and no longer have any dependents or liabilities. Which brings me to...

Q: If term insurance is so good, why not I buy it till 100? Isn't that a sure-earn? I only need to pay $200K total for $1M coverage!

A: Again, insurance isn't an investment. While there are some people pushing it, it is important to note that unlike a traditional investment, you:

- cannot 'withdraw' money if you need it

- cannot use the sum assured for collateral (e.g. to buy property)

- have to continually pay premium, or the policy will lapse

If you want to use it for inheritance, fine5. Otherwise, stick to a proper investment plan.

Other FAQ

Q: Are there really no benefits to whole life then? Surely it can't be that bad?

A: A whole life policy can be a way for the less disciplined to set aside money each year. Additionally, if you pay over a shorter premium term e.g. 10/15 years, you do not have to pay anything after, unlike the term life. Also, as you will get the sum assured (plus bonuses) upon death, it can be a way to provide inheritance for your children.

Of course, the same can be done with term life + an investment strategy.

Q: How about critical illness (CI) coverage? Is it worth it?

A: Yes. CI coverage covers against cancer, stroke, heart attack and other serious diseases8 which, if they don't kill you outright, can leave you unable to work. Buying a CI rider will accelerate10 the sum assured in the event of diagnosis of one of these illnesses, helping to cover you when you are unable to work.

Note: This is NOT the same as hospitalization insurance (shield plans). Hospitalization insurance pays for the cost of treatment and surgery. After you leave the hospital, you're on your own. CI coverage is to help defray your living costs due to lack of income.

Q: Should I buy Early Critical Illness (ECI) cover?

A: This is a topic I am currently considering and researching myself. The additional coverage is nice to have considering the standard critical illness definitions are becoming stricter. However, unlike the standard CI definitions, ECI definitions are not standard and vary by insurance company9. Nontheless, covering a smaller sum, say $200,000 can be an option.

Q: How much insurance should I buy?

A: My personal ideology is to cover approximately 10 years of your income, or $1M, whichever is less. Otherwise, you can go with the traditional methods of calculating your assets and liabilities. It is better to over-buy than under-buy (within reason).

Q: Shouldn't I wait until I have dependents before buying insurance?

A: Premiums are cheaper overall the earlier you buy. For example, for a sum assured of $300,000, if you were to buy term insurance for 50 years (till 75) when you are 25, you would pay $28,425 total in premiums. However, if you were to buy term insurance for 35 years (till 75) when you are 40, you would pay $33,784 total in premiums.

-

Wasn't that the main reason you were going to buy whole life insurance? :) ↩

-

Mathematically speaking, a multiplier component on a whole-life policy is equivalent to purchasing an additional term insurance over the same duration. For example, a $100,000 whole life policy with a 2x multiplier up to 75, is equivalent to buying the basic $100,000 whole life policy and then buying another $100,000 term insurance till 75. ↩

-

The median inflation rate for Singapore was 1.72%pa from 1961-2021 (source). At this rate, $100 now will be worth $84, 10 years in the future. ↩↩

-

Do note there is a 'risk' that you will live beyond 100 and thus not get your payout - around 4%, to be exact. ↩

-

To be exact, you could calculate the total inflation-adjusted premiums for term and whole life for a more accurate comparison. ↩

-

The standard definitions of 37 critical illnesses can be found here. The definitions have become stricter over time, e.g. a lot of early cancers are excluded, so it helps to buy your policy earlier while you can. ↩

-

For example, under early stage cancer, HSBC covers neuroendocrine tumours and bone marrow malignancies, while Prudential does not. ↩

-

The term 'accelerate' means that the sum assured is paid out earlier, based on the terms of the rider. It is in effect 'accelerated'. ↩